nebraska sales tax percentage

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832.

Sales Taxes In The United States Wikipedia

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

. The Nebraska state sales and use tax rate is 55 055. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. The applicate tax rate for.

New State Sales Tax Registration. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55.

The base state sales tax rate in Nebraska is 55. While many other states allow counties and other localities to collect a local option sales tax. Nebraska Sales Tax Rate Finder.

What is the sales tax rate in Omaha Nebraska. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

This is the total of state county and city sales tax rates. The total tax rate might be as high as 75 percent depending on individual municipalities however food and. The Nebraska NE state sales tax rate is currently 55.

The current state sales tax rate in Nebraska NE is 55 percent. Nebraska sales tax details. The Wahoo Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Wahoo local sales taxesThe local sales tax consists of a 150 city sales tax.

Sovos is your sweet spot for sales tax compliance. Nebraska has recent rate changes Thu Jul 01. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

Groceries are exempt from the Nebraska sales tax. Average Sales Tax With Local. Ad Get Nebraska Tax Rate By Zip.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. When calculating Nebraskas sales and use tax determine the taxes the local jurisdiction charges for the city and county then add those percentages to the state sales tax percentage of 55.

Find a more refined approach to sales tax compliance with Sovos. Free Unlimited Searches Try Now. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. Find your Nebraska combined state. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

With local taxes the total sales tax rate is between 5500 and 8000. What is the sales tax rate in Lincoln Nebraska. Counties and cities can charge an.

30 rows The state sales tax rate in Nebraska is 5500. If the seller is. Ad Need a dependable sales tax partner.

LB 873 reduces the corporate tax rate imposed on Nebraska taxable income in excess of 100000 for taxable years beginning on or after January 1 2024. Ad Nebraska Sales Tax information registration support. 536 rows Nebraska Sales Tax55.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

Historical Nebraska Tax Policy Information Ballotpedia

Nebraska Tax Forms And Instructions For 2021 Form 1040n

Nebraska Payroll Taxes A Complete Guide

Kansas Sales Tax Rates By City County 2022

2020 Nebraska Property Tax Issues Agricultural Economics

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Pennsylvania Sales Tax Guide For Businesses

A Twenty First Century Tax Code For Nebraska Tax Foundation

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Taxes In The United States Wikipedia

Taxes And Spending In Nebraska

Nebraska Sales Tax Guide For Businesses

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Taxes At A Glance Open Sky Policy Institute

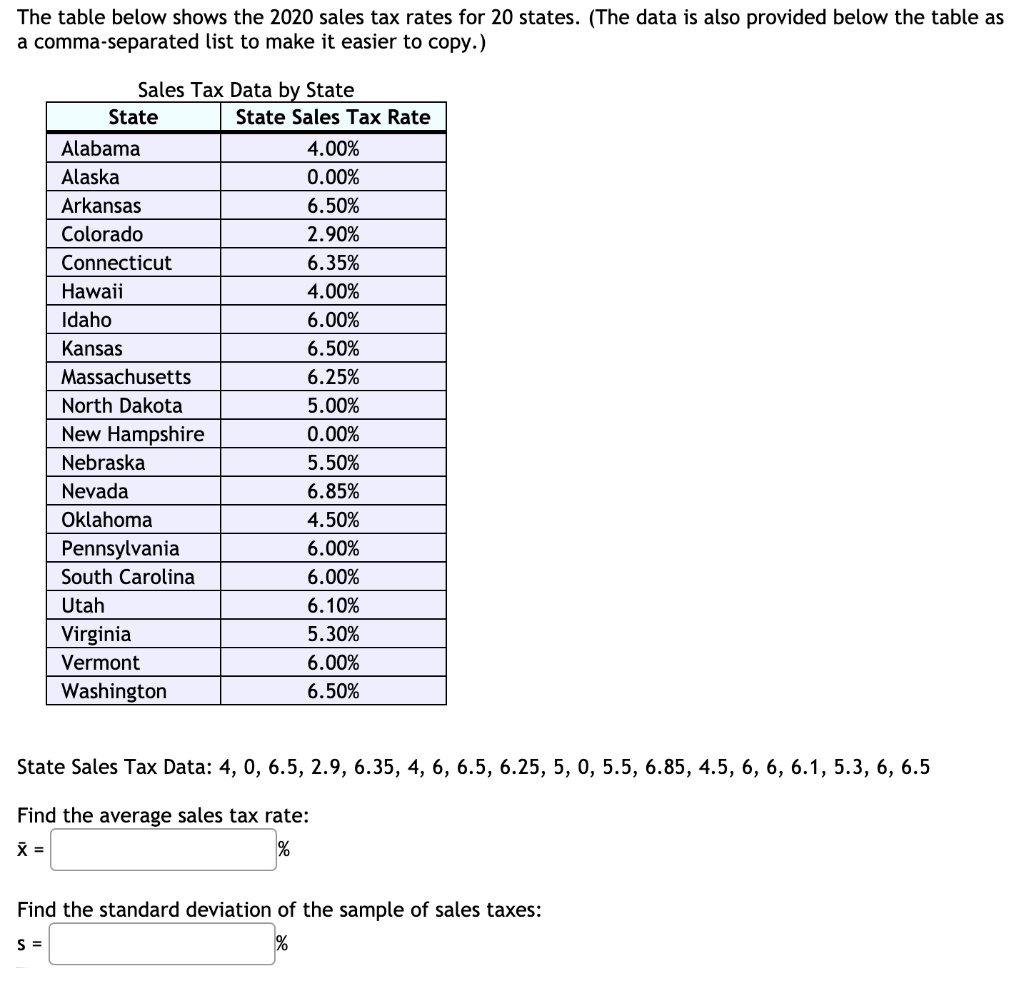

Solved Could You Help Me Figure Out What The Average Sales Chegg Com

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare